Which of the Following Are Liabilities to a Bank

So it is liability for the bank. Which of the following statements is false.

Solved Robinson Company Solutionzip Robinson Company Cost Of Goods Sold

A Discount loans b Reserves c US.

. Mutual fund etc The asset products are those. Which of the following are liabilities to a bank. Treasury securities d Real estate loans.

O capital stock and reserves O property and capital stock O demand and time deposits O vault cash and demand deposits. The coupon rate is the interest rate promised when a bond is issued When a consumer wants to compare the price of one product with another money is primarily functioning. Specifically the bank owes any deposits made in the bank to those who have made them.

If the reserve requirement were 15 percent the value of the monetary multiplier would be 667. C indicates whether or not the bank is profitable. Checkable deposits are those deposits which a bank has to pay when the depositors demand from the bank.

A shows that total assets equal total liabilities plus equity capital. The following are the banks liabilities or obligations which are due to its stockholders and creditors. A A bankʹs assets are its sources of funds.

B the capital stock is a liability and the cash is an asset. B illiquid but not insolvent. C the capital stock is part of the net worth of the bank and the cash is a liability.

Capital stock and reserves. A bank sells a T-bill to a pension fund and repurchases it on an agreed-upon date. B expanded dramatically over time.

Which of the following are liabilities on a banks balance sheet. D Bank capital is recorded as an asset on the bank balance sheet. Share prices for the Big Six.

Which of the following are reported as liabilities on a banks balance sheet. B Bank runs happen because depositors have irrational wrong beliefs about banks solvency. A the capital stock is an asset and the cash is a liability.

B lists sources and uses of bank funds. Demand and time deposits If the reserve requirement were 15 percent the value of the monetary multiplier would be 667 The Federal Open Market Committee FOMC of the Federal Reserve System is primarily for setting the Feds monetary policy and directing the purchase and sale of government securities. B A bank issues liabilities to acquire funds.

20 - Which of the following statements is false. Business Accounting QA Library The accounting records and bank statement of Jeffs Seashell Store provide the following information at the end of April. D does all of.

When a bank sells capital stock equity shares in return for cash. Net worth is included on the liabilities side to have the T account balance to zero. C A bankʹs balance sheet shows that total assets equal total liabilities plus equity capital.

A bank sells a T-bill to a pension fund and repurchases it on an agreed-upon date. Savings account current account salary account 2. B A banks liabilities are its uses of funds.

When bank customers deposit money into a. Only a and b of the above 10. A A banks assets are its uses of funds b A bank issues liabilities to acquire funds The banks assets provide the bank with income Bank capital is recorded as an asset on the bank balance sheet 0 d.

All of the above e. Which of the following are liabilities to a bank. Capital StockAt the organization of the bank its shares are purchased by individuals who must pay cash for themThe bank thus becomes accountable to the shareholders for the amount of the capital stock and hence it is carried as a liability.

A A bankʹs assets are its uses of funds. A balance sheet is an accounting tool that lists assets and liabilitiesAn asset is something of value that is owned and can be used to produce something. The closing Cash account balance was 29000 and the bank statement shows a closing balance of 31000.

On reviewing the bank statement it is found an account customer has deposited 2500 into the bank account for a. Liabilities are what the bank owes to others. C A banks balance sheet shows that total assets equal total liabilities plus equity capital.

A bank borrows from the Federal Reserve. See the answer See the answer See. Which of the following are liabilities to a bank.

Economics questions and answers. Hence it is reported as liabilities on balance sheet of bank. D A bankʹs balance sheet indicates whether or.

Demand and time deposits. The original intention of the Feds role as lender of last resort was to make loans to banks that were A not illiquid nor insolvent. Which of the following are liabilities to a bank.

4 The share of checkable deposits in total bank liabilities has A expanded moderately over time. Which of the following statements are true. Which of the following statements are TRUE.

Below are some of the products. A home provides shelter and can be rented out to generate income. C The bankʹs assets provide the bank with income.

D Bank capital is an asset on the bank balance sheet. D A banks balance sheet indicates whether or. Bank capital is recorded as an asset on the bank balance sheet.

Vault cash and demand deposits. When you deposit 50 in currency at Old National Bank a. D All of the above 14.

Recessions tend to hit bank stocks a lot harder. Its reserves increase by 50. For example the cash you own can be used to pay your tuition.

A Banks Balance Sheet. A A banks assets are its sources of funds. The net worth or equity of the bank is the total assets minus total liabilities.

Economics questions and answers. Demand and time deposits. B A bankʹs liabilities are its uses of funds.

Liability products for the banks include all the accounts where the customer deposits money. This problem has been solved. A pension fund buys a credit default swap.

Answer 1 of 11. 4 A banks balance sheet. A bank sells a mortgage to another bank.

C Bank runs are less likely happen with deposit insurance. Recession clouds are moving in and Canadian bank stocks are down but the case for buying the dip has a serious flaw.

A01v Introduction To Accounting Exam 1 Answers Attempt 1 Ashworth Accounting Exam Exam Business Questions

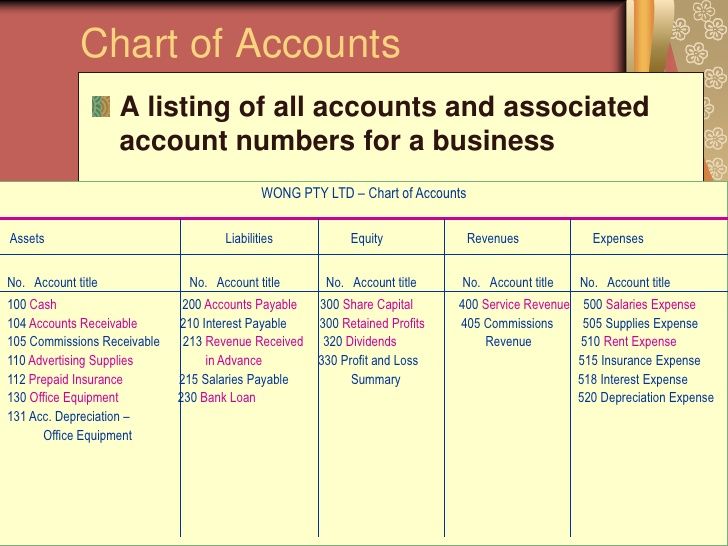

General Ledger Account Numbers Chart Of Accounts Accounting Chart Of Accounts General Ledger

Chart Of Accounts Chart Of Accounts Accounting Contract Template

No comments for "Which of the Following Are Liabilities to a Bank"

Post a Comment